Loan Info

Before your Purchase, please evaluate your finances…

Buying a property is indeed exciting and many jump straight into searching for their property without evaluating their finances first.

If you are not intending to pay full for your purchase, financing is definitely a very crucial consideration.

If one committed to a purchase and realise that he could not afford it, the experience is nerve wracking and painful to forfeit the down-payment.

Hence, we strongly recommend you to get an in-principle loan approval (IPA or AIP) before your searches. IPA from banks provide good assessment on the loan amount you would be able secure, giving you peace of mind when hunting for your ideal house.

What is Housing Loan?

Housing loan is also known as property loan, home loan or mortgage loan.

It is a secured loan that the borrower adopted from the bank to finance the purchase of a property, and the property is pledged as collateral to the bank.

| New Purchase: |

To finance their purchase of a new property, maybe for own stay or for investment. |

| Refinancing: |

Most banks’ packages have better interest rates for first few years, hence people tend to refinance to get lower rates again after the lock in period. Refinancing however will involve legal expenses and this should be taken into consideration when changing the bank packages. For comparison, it is to weigh the cumulative interest expenses (payment to the bank which does not clear your principal) for the first 3 years or within the lock in period. To compare the differences on your loan monthly instalment and interest expenses of 2 bank packages, you may use our ‘Loan Calculator’. You can also contact us and we would be happy to work out the loan comparison. |

Besides housing loans, there are several type of loans that are associated with property purchase or refinancing:

| Bridging Loan: |

This loan is only applicable when you have an existing property for sales. While you have not receive the sales proceed of your existing property and that you need to finance your new purchase, this is a short term loan (up to 6 months) which is taken to assist buyer to bridge over this period. |

| Construction Loan: |

This loan is taken to finance the construction, addition or alteration of an existing property, usually for a landed property. Upon completion, with architect certified TOP of the property, bank may approve on a case by case basis the re-structure of the construction loan to housing loan, especially if the property value has seemed increase with the newly constructed. |

| Equity or Term Loan or Cash Out: |

When a property appreciates in value and when outstanding loan amount reduced over time, the collateral property may be re-mortgaged to generate additional cash for general purposes. As most equity loans have the same lower housing loan rates, this serves as an alternative compared to business loan or overdraft for investors. The eligibility of an equity loan depends on the number of properties owned, valuation of property, the CPF amount and accrued interest used and income of the borrower. Do note that the repayment of the equity loan is only by Cash. |

What to consider when taking a Housing Loan?

- Loan Quantum – i.e. the loan amount.

The maximum quantum depends on the borrower’s income and credit worthiness, which are subjected to bank evaluation. - Loan to Value Ratio (LTV) – the loan amount in proportion to the valuation or acquisition price, whichever is lower.

- Loan Tenure – The duration to repay the loan

The loan quantum, LTV, Loan Tenure and Ages of Borrowers* are co-related.

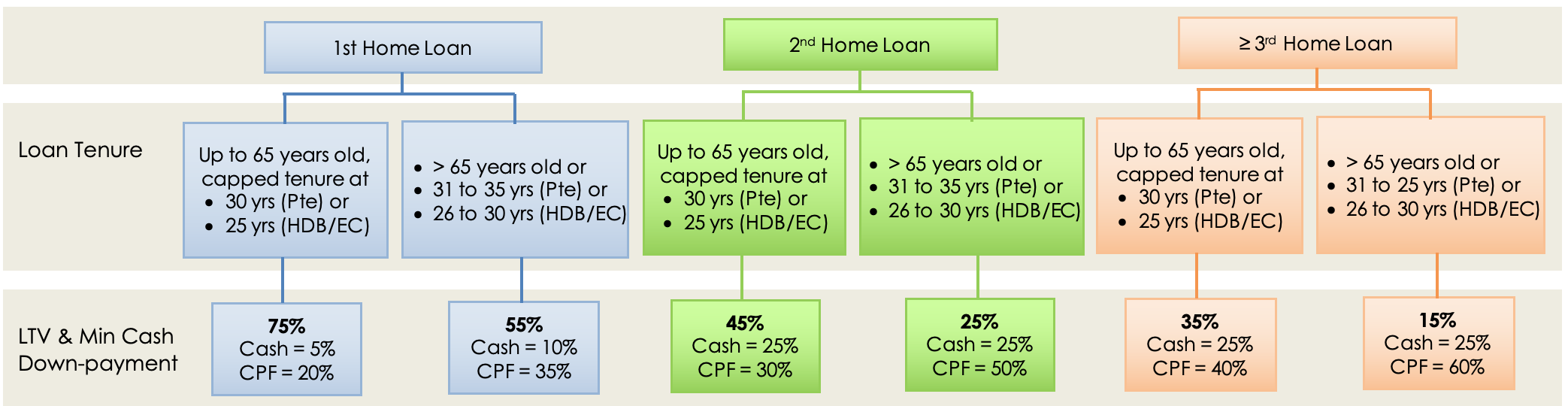

Below diagram illustrates the max LTV entitlement for New Acquisition by Individual Borrower for Residential Property.

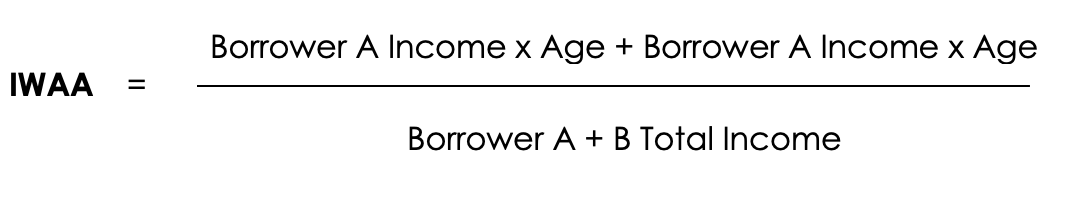

* Age of borrowers are determined by income weighted average age (IWAA)

Example

Interest Rate – it is the percentage for the cost of use of money from the lender (bank).

There are different loan packages, which consist of fixed rates as well as variable rates which can be pegged to bank board rates, bank fixed deposit rates or SIBOR/SORA. The selection of the package will depend on your risk appetite as well as financial considerations, such as if the property is under construction or completed, if you selling your property soon etc.

Lock-in Period – the obligatory period to continue your loan with your lender. If you redeem your loan partially or fully within the lock in period, typically there is a penalty to be paid to the bank. There might be many options to consider, please feel free to call us at 64790809 for no-obligation discussion and free housing loan analysis.

Bank evaluation for borrower’s eligibility

Total Debt Servicing Ratio (TDSR)

TDSR refers to the portion of a borrower’s gross monthly income that goes towards repayment the monthly debt obligations, including the loan being applied for.

TDSR calculates the percentage of your income that you can use to service your home loan, with a cap at 60%.

That is, the total repayment obligations for all your loans (including car loans, personal loans, overdrafts, credit card debts, etc.) cannot exceed 60% of your income. TDSR is applicable to all property buyers and for all property transactions.

Mortgage Servicing Ratio (MSR)

MSR refers to the portion of a borrower’s gross monthly income that goes towards repaying all mortgages, including the loan being applied for.

MSR calculates the percentage of your income that you can use to service your home loan, with a cap at 30%.

That is, the total repayment obligations for all your mortgages/housing loans, regardless of other debt obligations, cannot exceed 30% of your income. MSR is applicable to HDB flat and executive condominium buyers.

For more details, please refer to here.

For those who earns a variable income such as self-employed, commission-based personnel, their income reported will be subjected to a further 30% haircut.

If one could not secure sufficient loan for his purchase and wish to increase his lending ability. He could do pledging or un-pledging cash assets.

- Pledging assets = 4 years deposit with the financial institution

- Un-pledging or showing assets does not require 4 years deposit with the financial institution, however the amount to un-pledge or show to the financial institution is usually a few times higher than the pledge amount.

Interest Rates (Fixed vs Variables)

|

Type of Rates: |

(1) Fixed Rates |

(2) Variable Rates – SIBOR/SORA pegged |

(3) Variable Rates – Bank board rates pegged |

(4) Variable Rates – Bank fixed deposit rates pegged |

|

Example: |

Yr 1 to 3 at 1.5% fixed |

3mth SIBOR + 1% |

BR @ 5% - 3.5% = 1.5% floating |

BFD9 @ 1% + 0.5% = 1.5% |

|

Features: |

Fixed interest rates do not fluctuate within the set period. It remains constant regardless to changes in market conditions. |

Interest rates pegged to Singapore Inter-bank Offer Rate (SIBOR) or Singapore Overnight Rate Average Rates (SORA). Only the SIBOR or SORA move while the mark-up/spread (in above example, the + 1%) remain constant. SIBOR and SORA are influenced by prevailing market conditions. |

Interest rates pegged to the Bank’s respective reference rate (in the above example, BR = 5%), which is influenced by market conditions as well as banks’ decision to revise the bank board reference rates. |

Interest rates pegged to the Bank’s respective bank prevailing fixed deposit rate (in the above example, BFD9 may refer to the bank 9months SGD fixed deposit for a certain amount range, currently at 1%). The rates will change should the banks adjusted their respective fixed deposit rates. |

|

Monthly Repayment: |

The monthly payments stay the same within the set period. You will know how much money you will need each month for your instalments |

As interest rates are adjusted according to the movement of SIBOR or SORA, usually every 1 month or 3 months, the repayment amount will be also change accordingly. |

The monthly repayments stay consistent till the bank made any changes to the board rates. While reference rates change, the interest rates may increase/decrease and so the monthly repayment too. |

The monthly repayments stay consistent till the bank adjusted the respective fixed deposit rates. While the reference fixed deposit rates change, the interest rates may increase/ decrease and so the monthly repayment too. |

|

Lock in: |

Usually the lock in period is tied to the number of years of fixed rates. i.e. 3 years fixed = 3 years lock in. |

There is a range of no lock in to 1 year, 2 years or 3 years lock in packages. Typically the spread is lower with longer lock in period. |

Similar to (2) SIBOR/SORA pegged rates, there is a range of no lock in to 3 years lock in packages, rates typically lower with lock in. |

Similar to (2) SIBOR/SORA pegged rates, there is a range of no lock in to 3 years lock in packages, rates typically lower with lock in. |

|

Risk: |

Fixed rates offer certainly and hence low risks. As bank is absorbing the fluctuation risk, fixed rate are usually priced higher than the variable rates at any point, and hence fixed rates are adopted if client prefers certainty or that they anticipate an increase in the interest market. |

Variable rates fluctuate according to market conditions, and hence compared to fixed rates, it is of higher risk. However this kind of variable packages offers higher transparency than board rate pegged variable packages, as adjustment is not up to the bank’s discretion. |

Banks usually offer low interest rates for floating rate packages to entice home buyers. This kind of variable packages does not change very often, however there is no transparency and adjustment to the board rates is at the bank’s discretion. |

Similar to (3) Bank Board rates pegged, the adjustment to the rates is at the bank’s discretion. |

|

Property Type & Considerations |

Mostly for completed properties that are not selling any time soon. |

For both completed and uncompleted properties. Most popular for properties with progressive payment scheme and well-liked among those that have low outstanding loan that wish to keep the package for long term. |

For both completed and uncompleted properties. |

For both completed and uncompleted properties. |

This may sound confusing, with too many substance to consider, please feel free to call us at 64790809 or email us at enquiry@sgloanadvisor.com and we would have our friendly consultant be in touch with you for a no-obligation discussion and free housing loan analysis.

Housing Loan Repayments

The borrower will make repayment in monthly instalments. The instalments will comprise the repayment of a Principle portion as well as an Interest portion. To calculate your loan monthly instalment, you may use our ‘Loan Calculator’.

If the borrower fails to make repayment on the housing loan, the banks or financing institutions could foreclose the property and sell it to pay off the loan.

Down-payment and Bank Loan Disbursement

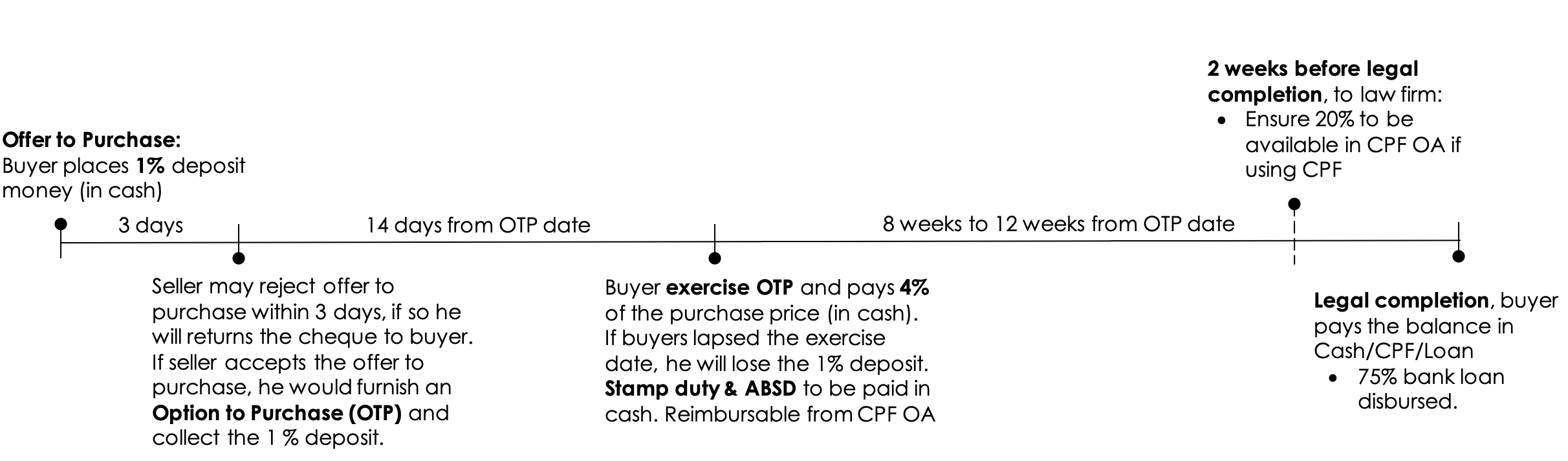

Down-payment and Bank Loan Disbursement for a Completed Private Property.

Buyer taking maximum 75% bank loan.

The illustration below is an indication for reference only, actual timeline subject to changes.

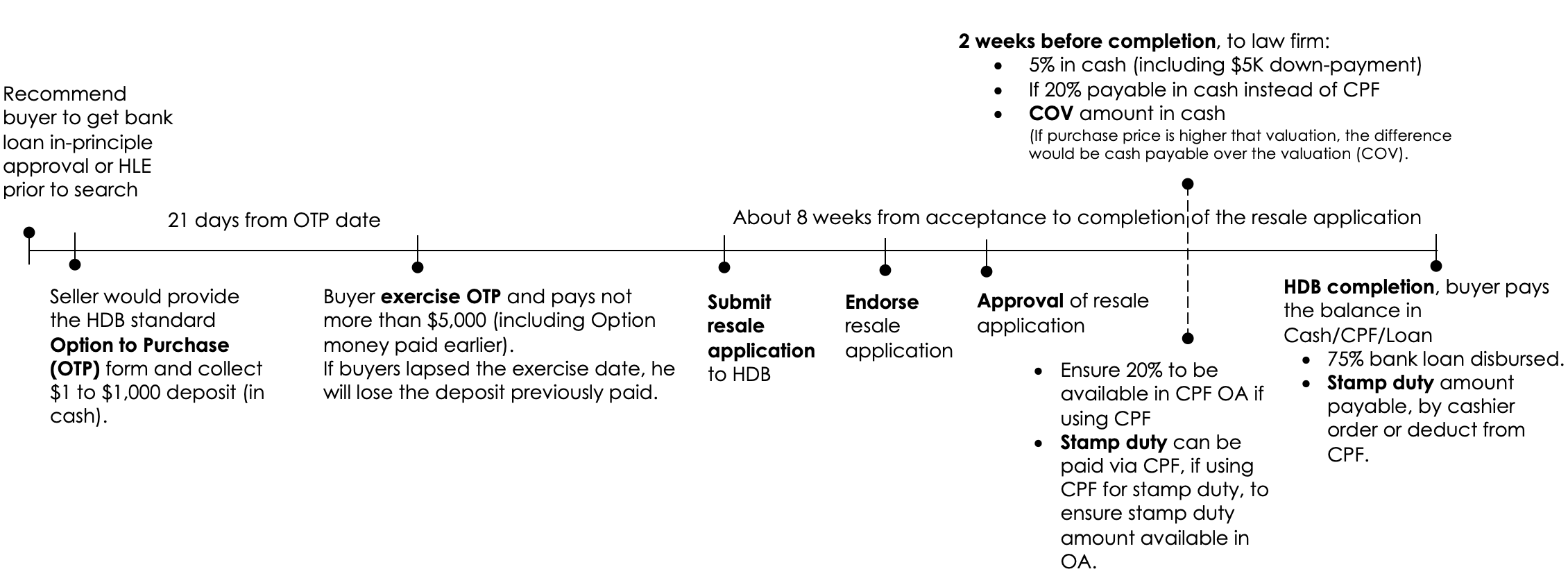

Down-payment and Bank Loan Disbursement for a Completed HDB Property

Buyer taking maximum 75% bank loan.

The illustration below is an indication for reference only, actual timeline subject to changes.

|

Progress: |

Booking |

S&P |

Foundation |

Framework |

Wall |

Ceiling |

Windows |

Car Park |

TOP |

CSC |

|

|

Upon the grant of Option to Purchase |

Upon signing of sale & Purchase Agreement or within 8 weeks from the Option date |

Completion of foundation work |

Completion of reinforced concrete framework of unit |

Completion of partition walls of unit |

Completion of roofing / ceiling of unit |

Completion of door subframes/ |

Completion of car park, |

Temporary Occupation |

Legal completion |

|

Payment % |

5% |

15% |

10% |

10% |

5% |

5% |

5% |

5% |

25% |

15% |

|

(1 Pty Loan) LTV 75% |

Cash |

CPF or Cash |

5% CPF or Cash and 5% Loan |

Loan |

Loan |

Loan |

Loan |

Loan |

Loan |

Loan |

|

(2 Pty Loans) LTV 45% |

Cash |

Cash |

5% Cash and 5% CPF or Cash |

CPF or Cash |

CPF or Cash |

CPF or Cash |

CPF or Cash |

Loan |

Loan |

Loan |

|

(>= 3 Pty Loans) LTV 35% |

Cash |

Cash |

5% Cash and 5% CPF or Cash |

CPF or Cash |

CPF or Cash |

CPF or Cash |

CPF or Cash |

CPF or Cash |

5% CPF or Cash and 20% Loan |

Loan |

Down-payment and Bank Loan Disbursement for an Uncompleted HDB BTO Property.

Buyer taking maximum 75% bank loan.

The illustration below is an indication for reference only, actual timeline subject to changes.

Expenses Involved on Property Acquisition and Housing Loan

- Legal Fees

- You need to appoint a lawyer to do conveyance for:

- Purchasing of the property (acting on your behalf)

- Financing of the property (acting on your behalf and on behalf of the financer when you takes loan with them)

- Liaising with CPF for the withdrawal of your funds from the CPF board (if you are using CPF to finance the loan)

- There is no need to hire several lawyers for the various legal works, you can appoint one law firm that is within your selected bank’s panel and who can also act for the CPF Board.

- Legal fee estimated is between $1,500 to $6,000 depending on property type (such as BUC or Completed, Private or HDB), conveyance work involved (such as purchase, refinancing, part-purchase etc) as well as law firm appointed.

- CPF may be used for legal fees payment, depending on the law firm appointed.

- For refinancing, several banks are subsidising on the legal fee, and if subsidy provided, it is usually subject to 3 years claw back.

- Valuation Fees

- Estimated between $180 to $1,000 depending on property type (such as HDB or Private Condominium or Landed).

- For refinancing, some banks are subsidising on the valuation fee, and if subsidy provided, it is usually subject to 3 years claw back.

- Fire Insurance

- With mortgage, banks mandate borrowers to insure the property against fire.

- The yearly insurance premium is subject to the quotation by the insurer, based on loan amount, health condition and coverage etc.

- The insurer is usually a tied up agency determined by the bank, if you wish to change to another insurer, it is subject to the bank approval.

- Stamp Duties

This is a tax that buyer pay for the stamping on the legal document relating to immovable properties, such document includes the acceptance to Option to Purchase (OTP), Sale & Purchase Agreement (S&P) as well as the Mortgages document.

Buyer's Stamp Duty (BSD)

BSD is applicable to all buyers on all properties, and tax amount based on the valuation price or acquisition price, whichever is higher.

|

BSD Rate on all Property Acquisition |

|

|

1st $180K ($1 to $180,000) |

1% |

|

2nd $180K ($181,000 to $360,000) |

2% |

|

Next $640K ($361,000 to $640,000) |

3% |

|

above $1M |

4% |

For more details, please refer to https://www.iras.gov.sg/irashome/Other-Taxes/Stamp-Duty-for-Property/Working-out-your-Stamp-Duty/Buying-or-Acquiring-Property/What-is-the-Duty-that-I-Need-to-Pay-as-a-Buyer-or-Transferee-of-Residential-Property/Buyer-s-Stamp-Duty--BSD-/

Additional Buyer's Stamp Duty (ABSD)

There is additional buyer’s stamp duty (ABSD) for Singapore Permanent Residents (SPR) and foreigners, as well as for ownership of 2 or more residential properties. The following ABSD rates applicable to acquisition of residential properties with effect from 6 Jul 2018.

|

ABSD Rate on 1st Acquisition |

ABSD Rate on 2nd Acquisition |

ABSD Rate on 3rd & more Acquisition |

|

|

Singaporean Citizens |

NA |

12% |

15% |

|

Permanent Residents (SPR) |

5% |

15% |

15% |

|

Foreigners |

20% |

20% |

20% |

For acquisition made jointly by 2 or more parties, the higher applicable ABSD rate will be imposed.

Relief for ABSD will be for:

- Married couples with one Singaporean spouse and both spouses do not own any other property at the time of acquisition.

- Married couples with at least one Singaporean spouse, who has acquired a second property and will be disposing off their existing residential property.

Example of stamp duty (BSD + ABSD) payable for a property acquisition at $1 & $2 million:

|

Stamp Duty on 1st Acquisition |

Stamp Duty on 2nd Acquisition |

Stamp Duty on 3rd & more Acquisition |

||||

|

Purchase Price |

$1M |

$2M |

$1M |

$2M |

$1M |

$2M |

|

Singaporean Citizens |

$24,600 |

$74,600 |

$144,600 |

$304,600 |

$174,600 |

$364,600 |

|

Permanent Residents (SPR) |

$74,600 |

$164,600 |

$174,600 |

$364,600 |

$174,600 |

$364,600 |

|

Foreigners |

$224,600 |

$464,600 |

$224,600 |

$464,600 |

$224,600 |

$464,600 |

For more details, please refer to https://www.iras.gov.sg/irashome/Other-Taxes/Stamp-Duty-for-Property/Working-out-your-Stamp-Duty/Buying-or-Acquiring-Property/What-is-the-Duty-that-I-Need-to-Pay-as-a-Buyer-or-Transferee-of-Residential-Property/Additional-Buyer-s-Stamp-Duty--ABSD-/

Foreigners eligible for ABSD remission under Free Trade Agreements (FTAs)

Under the respective FTAs, Nationals or Permanent Residents of the following countries will be accorded the same Stamp Duty treatment as Singapore Citizens:

- Nationals and Permanent Residents of

- Iceland,

- Liechtenstein,

- Norway or

- Switzerland

- Nationals

- United States of America

Seller Stamp Duty (SSD)

|

Residential Properties |

Sell within 1 year |

Sell within 2 years |

Sell within 3 years |

Sell within 4 years |

|

Buy before 20 Feb 2010 |

No SSD applicable for properties acquired before 20 Feb 2010 |

|||

|

Buy on or after 20 Feb 2010 |

SSD payable, same rates as BSD |

NA |

NA |

NA |

|

Buy on or after 30 Aug 2010 |

SSD payable, same rates as BSD |

SSD payable, 2/3 of BSD |

SSD payable, 2/3 of BSD |

NA |

|

Buy on or after 14 Jan 2011 |

16% |

12% |

8% |

4% |

|

SSD computed based on % of selling price or market value, whichever is higher |

||||

|

Buy on or after 11 Mar 2017 |

12% |

8% |

4% |

NA |

|

SSD computed based on % of selling price or market value, whichever is higher |

||||

SSD payable by cash and to be rounded down to the nearest dollar.

SSD to be paid within 14 days from exercising of Option.

For more details, please refer to https://www.iras.gov.sg/irashome/Other-Taxes/Stamp-Duty-for-Property/Working-out-your-Stamp-Duty/Selling-or-Disposing-Property/Seller-s-Stamp-Duty--SSD--for-Residential-Property/

|

Industrial Properties |

Sell within 1 year |

Sell within 2 years |

Sell within 3 years |

|

Buy before 12 Jan 2011 |

No SSD applicable for industrial properties acquired before 12 Jan 2011 |

||

|

Buy on or after 12 Jan 2011 |

15% |

10% |

5% |

|

Industrial SSD computed based on % of selling price or market value, whichever is higher |

|||

For more details, please refer to https://www.iras.gov.sg/irashome/Other-Taxes/Stamp-Duty-for-Property/Working-out-your-Stamp-Duty/Selling-or-Disposing-Property/Seller-s-Stamp-Duty--SSD--for-Industrial-Property/

- Mortgage Insurance

- It is a policy that guarantees repayment of a mortgage loan in the event of death or disability of the mortgagor.

- Most mortgage insurance provides a lump sum pay out (assured sum), which gradually decreases as the home loan is paid off, however there are also term insurance that provide definite pay out.

- The insurance premium is subject to the quotation by the insurer, based on loan amount, health condition and coverage etc.

- Mortgage insurance is compulsory if you acquired a HDB flat and using your CPF to finance your loan, you will be automatically insured under the Home Protection Scheme (HPS). The HPS is a mortgage reducing insurance scheme administered by the CPF Board. HPS premium can be paid using your CPF money. If you would like to take on a private mortgage insurance package other than HPS, you would need to write in to CPF to request for exemption on HPS.

- If you acquired a private property, mortgage insurance is optional.

- Several banks have loan packages tied up with insurer on mortgage insurance, which borrowers enjoy discounted rates with the attainment of the mortgage insurance.

- Cash over Valuation (COV)

- Bank will finance your property based on the valuation price or acquisition price whichever is lower.

- For private property transaction, bank will consult the valuer within the bank’s panel for the valuation of the property.

- For HDB transaction, the seller will engage a HDB approved valuer to conduct valuation on the property and the valuation report is required to submit to the bank when processing mortgage loan. Bank will base on the value reported to determine the loan to value.

- For the amount higher than valuation, the difference is to be paid in cash before the loan disbursement, commonly known as cash over valuation (COV).

Disclaimer: All information and materials contained in these pages, including the terms, conditions, and descriptions are subject to change. Information may be amended at any time without notice at our discretion. In addition, we do not make any representations or warranties that the information we provide is reliable, accurate or complete or that your access to that information will be uninterrupted, timely or secure. We make our best effort to ensure accuracy of information in the Site, we do not warrant the accuracy, adequacy or completeness and expressly disclaim liability for completeness, accuracy, timeliness, reliability, suitability or availability with respect to the Site or the information and materials on the Site for any purpose.